Indirect Trade Routes Reveal China’s Strategic Patience Amid U.S. Tariff Tensions

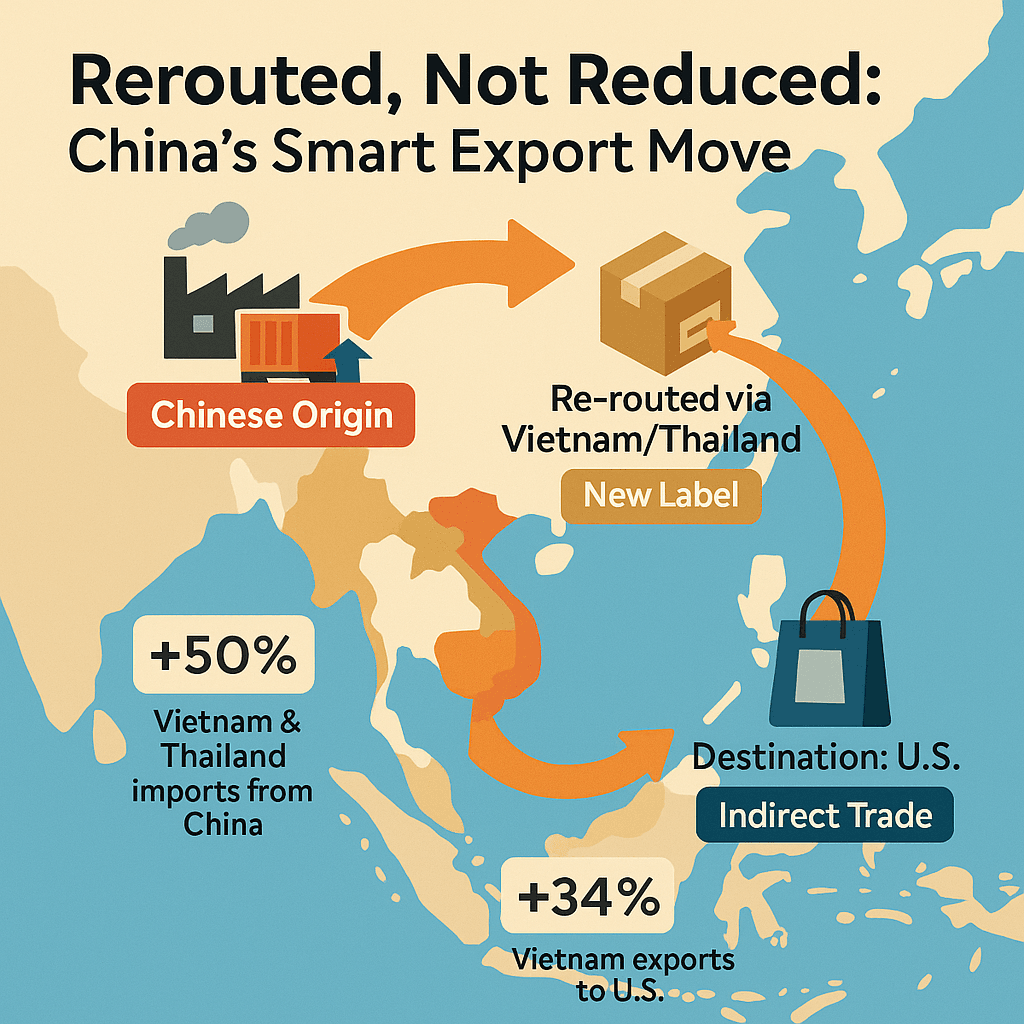

Recent trade data shows a striking trend: Chinese exports to Vietnam and Thailand have surged by over 50% since the start of 2025. At the same time, Vietnam’s exports to the U.S. reached over $12 billion in April—up 34% year-on-year and hitting their highest level since the pandemic began. Interestingly, Vietnam’s imports from China also hit a post-COVID high of more than $15 billion.

This rapid increase is unlikely to be a coincidence.

Many analysts believe these trade flows reflect a growing reliance on “transshipment”—where Chinese goods are first exported to neighboring countries before making their way to the United States. With U.S. tariffs on direct Chinese imports remaining steep, routing products through Vietnam or Thailand offers a workaround, albeit a more expensive one.

Robin Brooks of the Brookings Institution summed it up well: if China can still reach the U.S. market, even indirectly and at a higher cost, there’s little urgency for Beijing to re-engage in trade negotiations with Washington.

China’s strategy here is clear: absorb short-term costs, maintain export volume through regional partners, and bide time while waiting for a more favorable geopolitical or economic climate.

Meanwhile, this raises deeper questions for U.S. trade enforcement: Can tariffs remain effective if goods can be relabeled and rerouted? And will Washington pressure Southeast Asian nations to tighten transshipment oversight?

For now, China seems content watching from the sidelines—because business, even circuitous business, is still booming.